Business Insurance in and around New York

One of the top small business insurance companies in New York, and beyond.

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

Do you own an antique store, a flower shop or a sporting good store? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on your next steps.

One of the top small business insurance companies in New York, and beyond.

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Kevin Leong. With an agent like Kevin Leong, your coverage can include great options, such as business owners policies, commercial auto and artisan and service contractors.

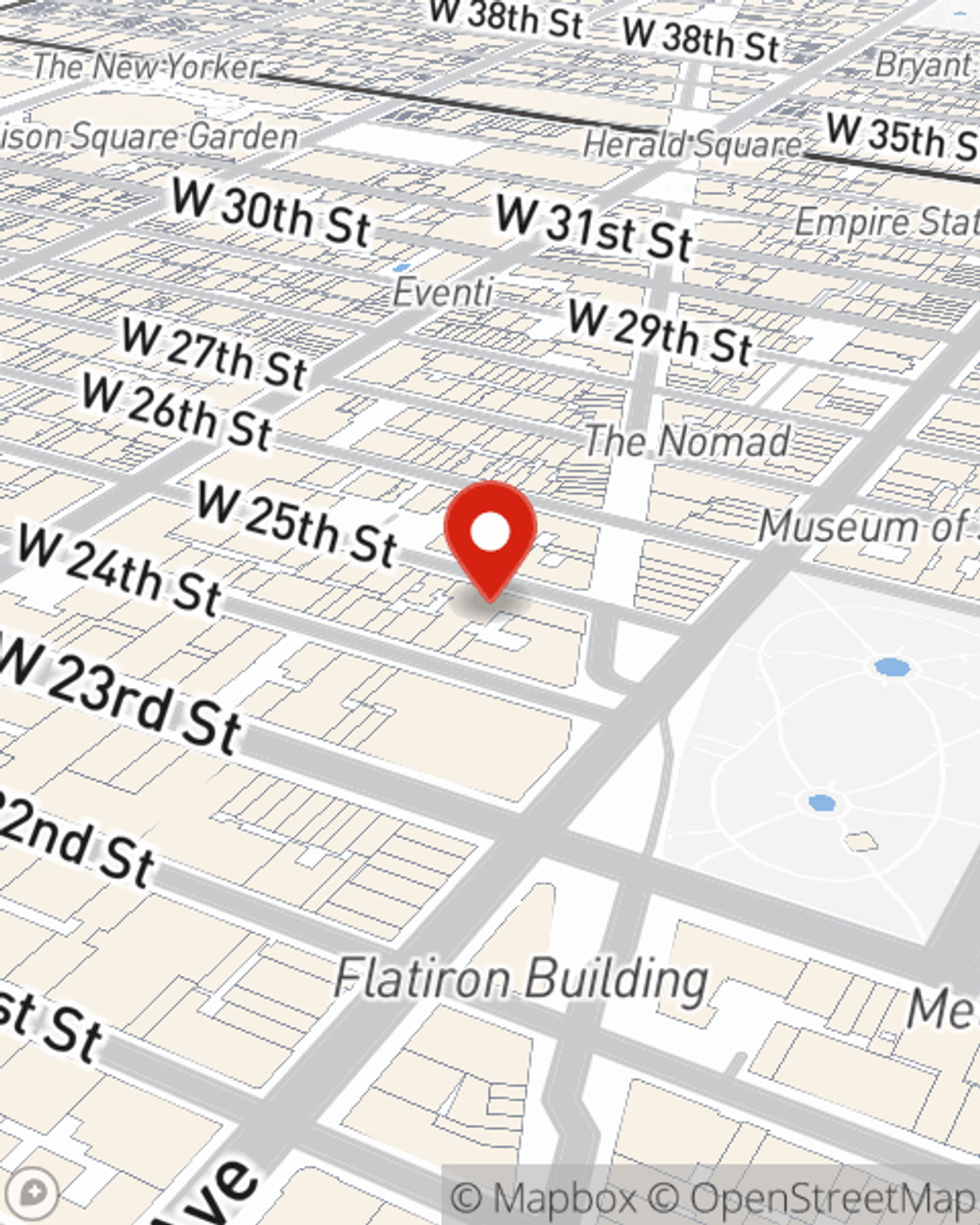

The right coverages can help keep your business safe. Consider visiting State Farm agent Kevin Leong's office today to discuss your options and get started!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Kevin Leong

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.